how are rsus taxed in california

RSUs are treated as supplemental income. RSUs can trigger capital gains tax but only if the.

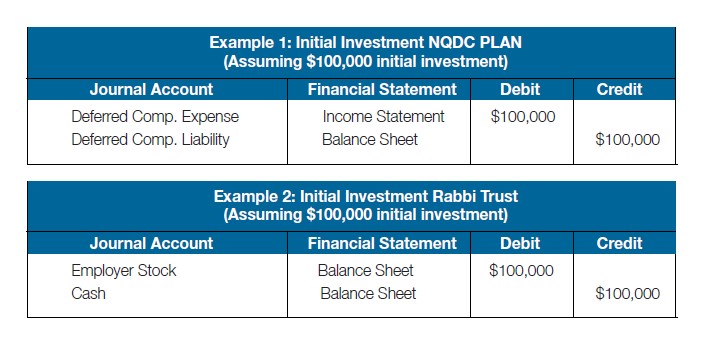

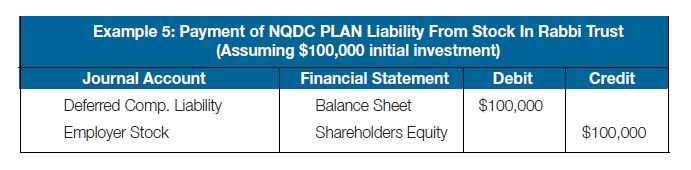

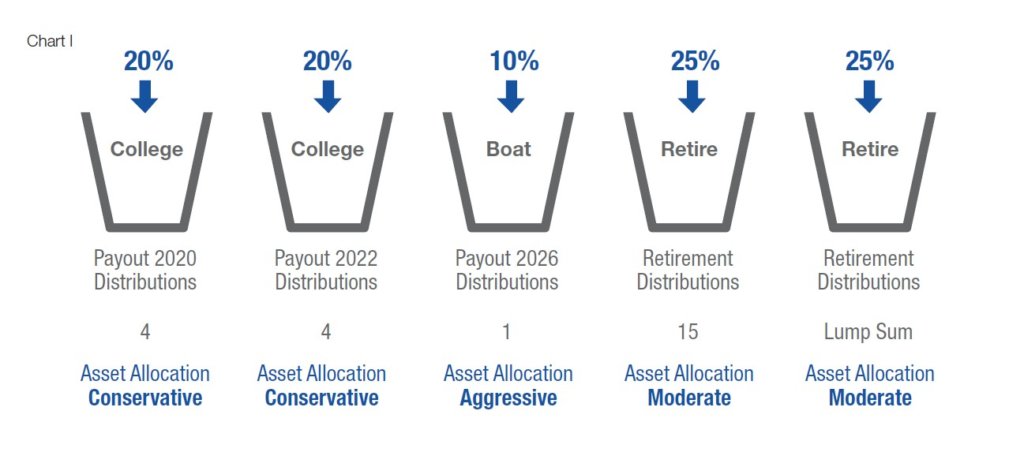

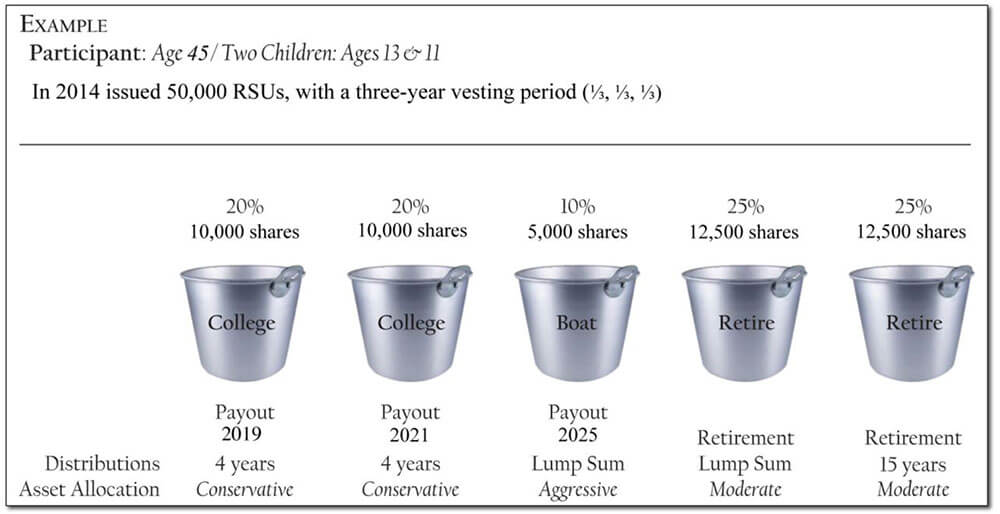

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Lets start with how taxes on Restricted Stock Units typically work.

. Your taxable income is the market value of the shares at vesting. Lets say one year has elapsed and you receive 30 shares of company stock of the 120 RSUs originally granted 25 per year vesting schedule. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Nonresident of California on Vesting Date. However its still important to understand and manage it appropriately. RSUs generate taxes at a couple of different milestones.

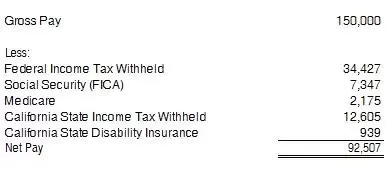

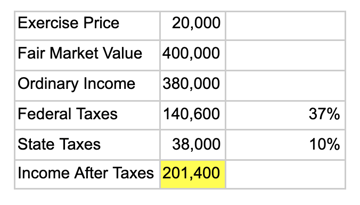

Your taxable income is based on the value of the shares at vesting. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

Californias Office of Tax Appeals issued a non-precedential decision on the states taxation of restricted stock units RSUs affirming the Franchise Tax Boards grant-to. Instead of getting the stock immediately they receive. The taxable income incurred on each vest is calculated as follows.

With RSUs you are taxed when the shares are delivered which is almost always at vesting. If you dont sell for a year plus a day it is only additional gains which are taxed as long term gains - you still have a tax liability in. If you are a nonresident of California on the date the stock vests the character of the income attributable to the vesting is.

At any rate RSUs are seen as supplemental income. RSUs including so-called double. The value of the rsus at the time of vesting is taxed as income.

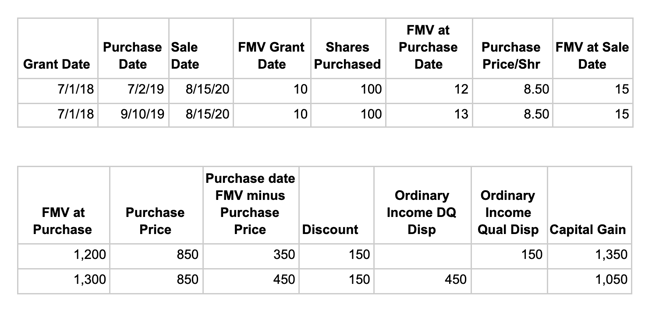

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. As the RSUs vest the value is taxed as income.

If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax 35k. Many companies withhold federal income taxes on RSUs at a flat rate of 22 37 for amount over 1 million. Once when you take ownership of the shares usually when they vest and again in another way when you.

You have compensation income. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward. 100 shares vest at.

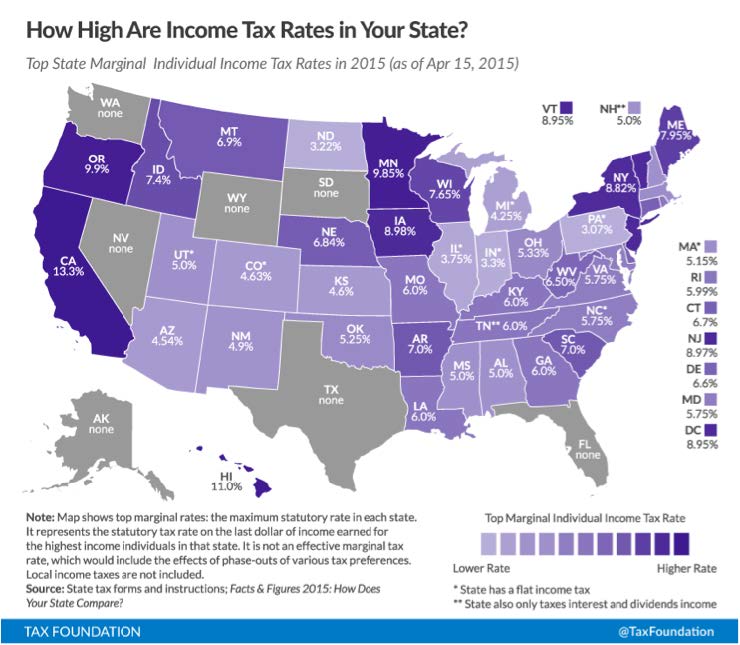

The value of over 1 million will be taxed at 37. The 22 doesnt include state. In all states RSUs are taxed as regular income based on value at time of vesting.

RSUs are generally taxable like salary when shares vest. Restricted stock units RSUs are becoming a more common type of equity compensation for California employees. How much will my RSUs be taxed.

Most companies will withhold federal income taxes at a flat rate of 22. If you then hold the vested shares for over one year before selling them then any additional gains. With RSUs you are taxed when the shares vest not when theyre granted.

This rate is 238 20 plus the 38 tax on net investment income. Theyre taxed as ordinary income - so its based on your marginal tax bracket. How are RSUs Taxed.

Your Guide To Stock Compensation Plans And Taxes

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Units Hayes Financial Inc

Your Guide To Stock Compensation Plans And Taxes

Your Guide To Stock Compensation Plans And Taxes

I M A Single 24 Year Old Renter Living In Silicon Valley And I Ll Make About 200 000 In Total Income This Year How Do I Avoid Giving 40 Away To Taxes Quora

Your Guide To Stock Compensation Plans And Taxes

Your Guide To Stock Compensation Plans And Taxes

The Mystockoptions Blog Tax Law Rates

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Is 190 000 Year Including Stock Options A Good Starting Salary For A Recently Graduated Engineer At Google California How Much Would I Be Making After Taxes How Much Would The Expenses Approximately Be

Do Rsus Count As Income For A Home Loan Carlyle Financial